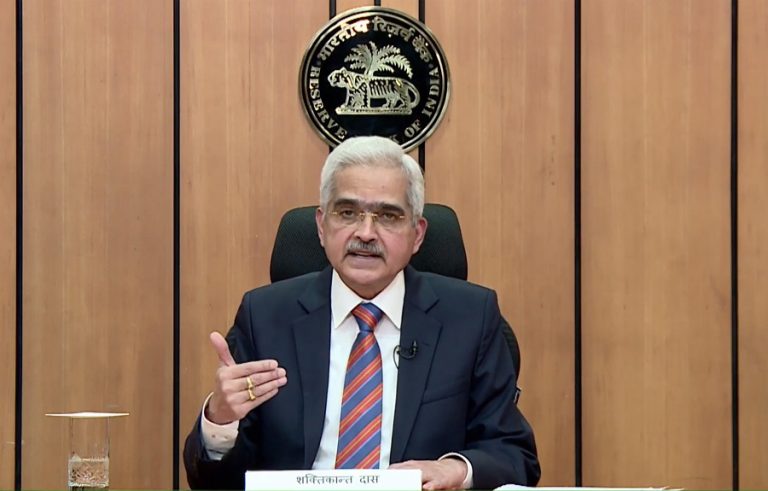

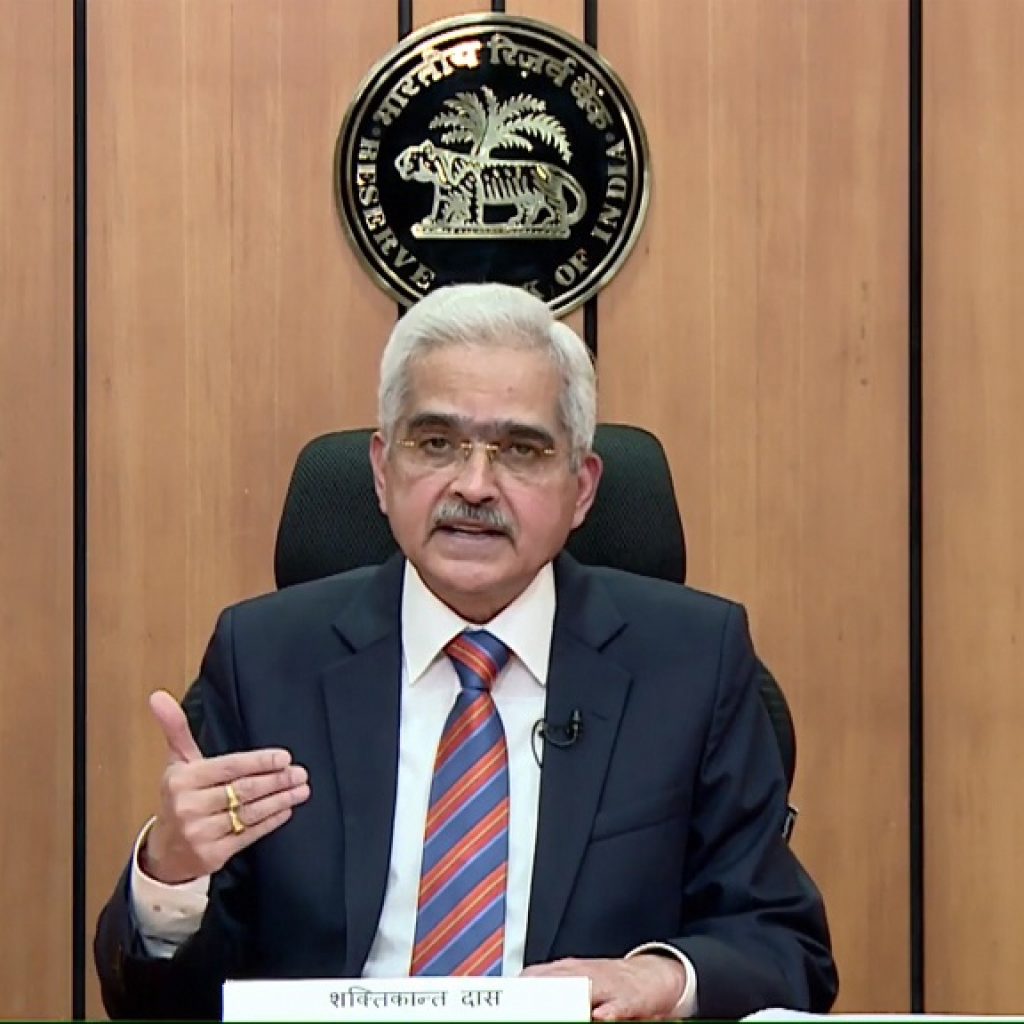

RBI Guv recommends Indian entrepreneurs to adjust to New Business Models

Mumbai (Maharashtra) [India]: Businesses are dealing with several difficulties positioned by shocks such as the global economic situation, COVID-19 pandemic, and also now the war