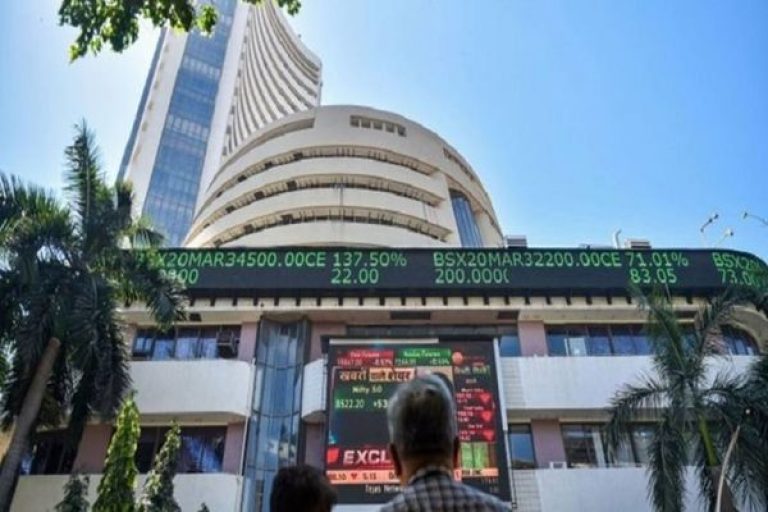

Indian share prices go down after 4-day gains; Rupee near all-time low in value

New Delhi [India]: Indian stock indices, after having actually prolonged gains for the fourth straight session till the previous session, dropped marginally on Thursday morning, tracking