Goods and Services Tax revenues increase 15 per cent to nearly Rs 1.50 lakh crore in December

New Delhi, Jan 1 (PTI) The collections from Goods and Services Tax (GST) increased by 15 per cent to over Rs 1.49 lakh crore in

New Delhi, Jan 1 (PTI) The collections from Goods and Services Tax (GST) increased by 15 per cent to over Rs 1.49 lakh crore in

New Delhi [India]: The central government has launched an amount worth Rs 17,000 crore to states and Union territories towards the balance GST compensation for

New Delhi [India]: Goods and Services Tax collection for the month of August was recorded at Rs 143,612 crore, which is 28 per cent greater

New Delhi [India]: Trade body Confederation of All India Traders (CAIT) has created a letter to the Principal Ministers as well as Finance Ministers of

Mumbai (Maharashtra) (ANI): Officers of CGST Mumbai South has busted a network of fictitious firms that issued fake invoices of Bullion of approximately Rs 1,650

New Delhi [India]: The gross GST revenue collected in the month of December 2021 is Rs 1,29,780 crore of which CGST is Rs 22,578 crore,

New Delhi [India]: Several states and UTs including Chhattisgarh, Rajasthan, and Delhi on Thursday urged Union Finance Minister Nirmala Sitharaman to extend GST compensation cess

The Indian Motion Picture Producers’ Association (IMPPA) on Wednesday wrote a letter to Union Finance Minister Nirmala Sitharaman, requesting her to abolish the Goods and

New Delhi [India] : The Central Government on Saturday informed the deadline for furnishing ‘Form ITC-04’ (intimation of goods sent on job work) for the

Islamabad [Pakistan] : Pakistan is in the throes of a deep economic crisis with the country requiring gross external financing of USD 51.6 billion within

Ahmedabad (Gujarat) [India]: Senior Congress leader Digvijay Singh on Sunday said that the way Goods and Services Tax (GST) was structured and implemented by the

The Gross Goods and Services Tax (GST) revenue collected in September 2021 is Rs 1,17,010 crore, informed the Ministry of Finance on Friday. New Delhi

Lucknow (Uttar Pradesh) [India]: The GST Council on Friday extended Goods and Services Tax concessions on COVID-related medicines till December 31 this year.Briefing media persons

Maharashtra Deputy Chief Minister Ajit Pawar on Thursday claimed that the Centre owes over Rs 30,000 crore to Maharashtra towards the Goods and Services Tax

Kozhikode (Kerala) [India], August 17 : Congress leader Rahul Gandhi on Tuesday slammed the Centre over demonetisation, GST, and farm laws saying that they are

New Delhi, Aug 11: Tamil Nadu Finance Minister Palanivel Thiaga Rajan has been vocal about his position on GST and never mince words in pointing

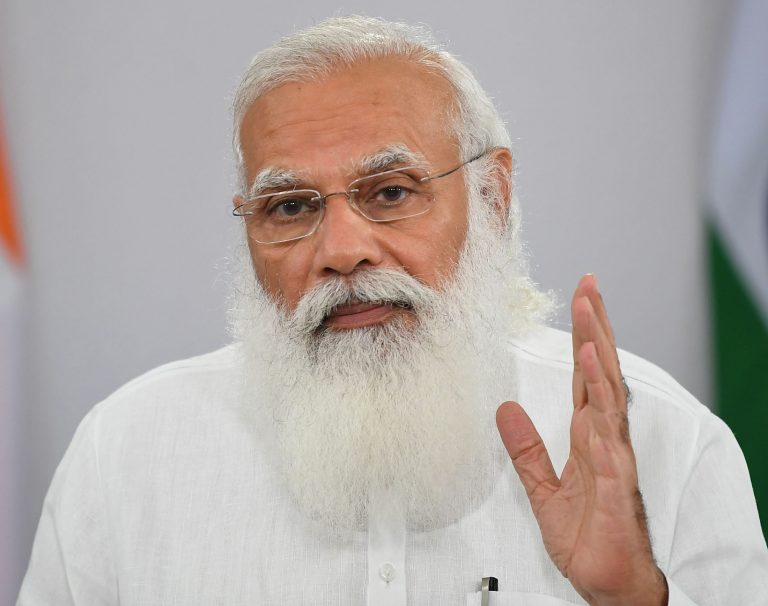

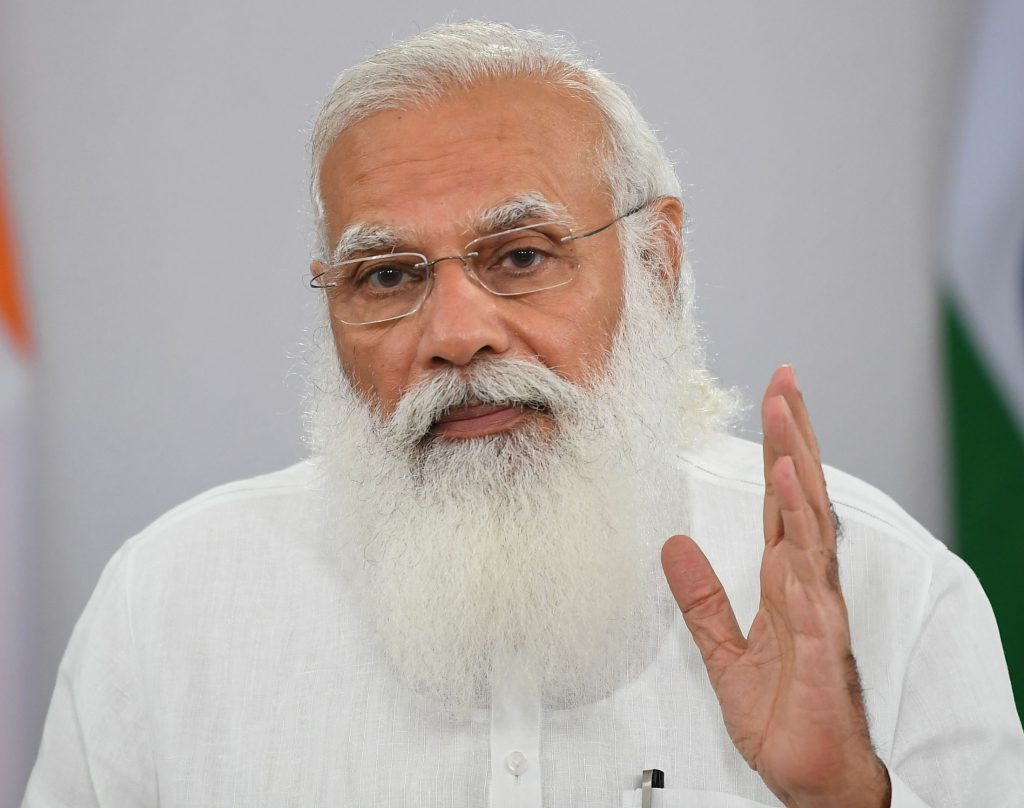

New Delhi [India]: Noting that reforms are not a compulsion but a conviction for the government, Prime Minister Narendra Modi on Wednesday said that the

Hamirpur (HP), Aug 3: Himachal Pradesh has registered a growth of 50.7 per cent in July 2021.The GST collected this month stands at Rs 473.81

Bhubaneswar (Odisha): Odisha recorded a Goods and services (GST) collection of Rs 3,615 crore during July 2021, 54 per cent higher than Rs 2,348 crore

New Delhi [India], August 2 : Prime Minister Narendra Modi on Monday expressed his optimism that 130 crore Indians will continue to work hard to

New Delhi [India] : Union Finance Minister Nirmala Sitharaman on Sunday said that Goods and Services Tax (GST) collection for July 2021 has again crossed

Goods and Services Tax (GST) collections for the month of June fell below Rs 1 trillion for the first time in months, government data released

New Delhi, Jan 1 (PTI) The collections from Goods and Services Tax (GST) increased by 15 per cent to over Rs 1.49 lakh crore in

New Delhi [India]: The central government has launched an amount worth Rs 17,000 crore to states and Union territories towards the balance GST compensation for

New Delhi [India]: Goods and Services Tax collection for the month of August was recorded at Rs 143,612 crore, which is 28 per cent greater

New Delhi [India]: Trade body Confederation of All India Traders (CAIT) has created a letter to the Principal Ministers as well as Finance Ministers of

Mumbai (Maharashtra) (ANI): Officers of CGST Mumbai South has busted a network of fictitious firms that issued fake invoices of Bullion of approximately Rs 1,650

New Delhi [India]: The gross GST revenue collected in the month of December 2021 is Rs 1,29,780 crore of which CGST is Rs 22,578 crore,

New Delhi [India]: Several states and UTs including Chhattisgarh, Rajasthan, and Delhi on Thursday urged Union Finance Minister Nirmala Sitharaman to extend GST compensation cess

The Indian Motion Picture Producers’ Association (IMPPA) on Wednesday wrote a letter to Union Finance Minister Nirmala Sitharaman, requesting her to abolish the Goods and

New Delhi [India] : The Central Government on Saturday informed the deadline for furnishing ‘Form ITC-04’ (intimation of goods sent on job work) for the

Islamabad [Pakistan] : Pakistan is in the throes of a deep economic crisis with the country requiring gross external financing of USD 51.6 billion within

Ahmedabad (Gujarat) [India]: Senior Congress leader Digvijay Singh on Sunday said that the way Goods and Services Tax (GST) was structured and implemented by the

The Gross Goods and Services Tax (GST) revenue collected in September 2021 is Rs 1,17,010 crore, informed the Ministry of Finance on Friday. New Delhi

Lucknow (Uttar Pradesh) [India]: The GST Council on Friday extended Goods and Services Tax concessions on COVID-related medicines till December 31 this year.Briefing media persons

Maharashtra Deputy Chief Minister Ajit Pawar on Thursday claimed that the Centre owes over Rs 30,000 crore to Maharashtra towards the Goods and Services Tax

Kozhikode (Kerala) [India], August 17 : Congress leader Rahul Gandhi on Tuesday slammed the Centre over demonetisation, GST, and farm laws saying that they are

New Delhi, Aug 11: Tamil Nadu Finance Minister Palanivel Thiaga Rajan has been vocal about his position on GST and never mince words in pointing

New Delhi [India]: Noting that reforms are not a compulsion but a conviction for the government, Prime Minister Narendra Modi on Wednesday said that the

Hamirpur (HP), Aug 3: Himachal Pradesh has registered a growth of 50.7 per cent in July 2021.The GST collected this month stands at Rs 473.81

Bhubaneswar (Odisha): Odisha recorded a Goods and services (GST) collection of Rs 3,615 crore during July 2021, 54 per cent higher than Rs 2,348 crore

New Delhi [India], August 2 : Prime Minister Narendra Modi on Monday expressed his optimism that 130 crore Indians will continue to work hard to

New Delhi [India] : Union Finance Minister Nirmala Sitharaman on Sunday said that Goods and Services Tax (GST) collection for July 2021 has again crossed

Goods and Services Tax (GST) collections for the month of June fell below Rs 1 trillion for the first time in months, government data released