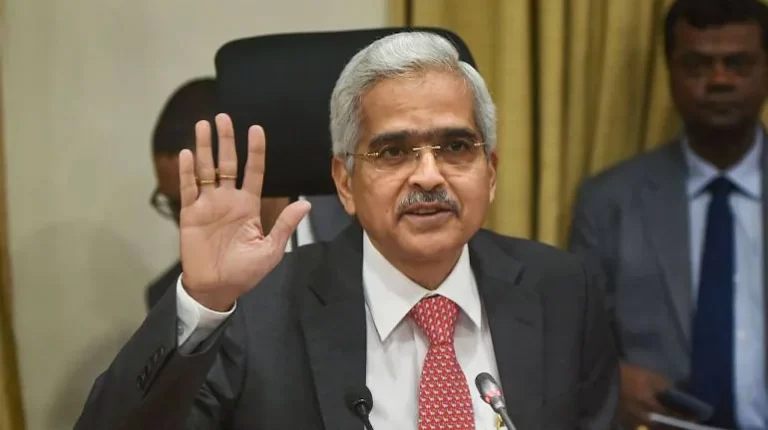

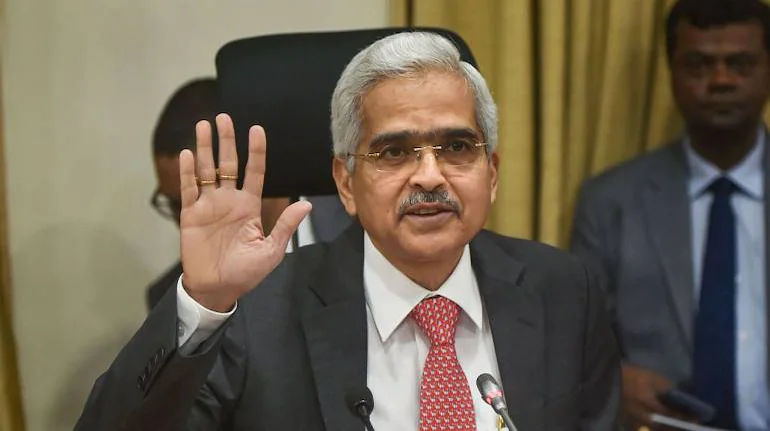

“India well positioned to continue to be fastest growing major economy next year,” says Tata Sons Chairman N Chandrasekaran

New Delhi: India is well positioned to continue to be the fastest-growing significant economic situation following year, which may mark the lowest international growth given