- PVR launches sustainability campaigns, join hands with actor Bhumi Pednekarby Subhankar MandalPVR launches sustainability campaigns, join hands with actor Bhumi Pednekar New Delhi: Leading multiplex operator PVR INOX Ltd on …

PVR launches sustainability campaigns, join hands with actor Bhumi Pednekar Read More »

- Sensex tanks nearly 900 points to close below 59k; Nifty tests 17,000by Shruti SharmaSensex tanks nearly 900 points to close below 59k; Nifty tests 17,000 Mumbai : Falling for the third straight …

Sensex tanks nearly 900 points to close below 59k; Nifty tests 17,000 Read More »

- Collapse of Silicon Valley Bank to impact Indian Startup Ecosystemby Shruti SharmaCollapse of Silicon Valley Bank to impact Indian startup ecosystem, feel experts Washington: The collapse of Silicon Valley Bank, …

Collapse of Silicon Valley Bank to impact Indian Startup Ecosystem Read More »

- SoftBank Group Founder Masayoshi Son meets startup founders in Delhiby Shruti SharmaSoftBank Group Founder Masayoshi Son meets startup founders in Delhi New Delhi: Billionaire investor and SoftBank Group Founder Masayoshi …

SoftBank Group Founder Masayoshi Son meets startup founders in Delhi Read More »

- Why has SEBI not yet got to bottom of Mauritius funds holding and trading Adani stock: Raghuram Rajanby Subhankar MandalWhy has SEBI not yet got to bottom of Mauritius funds holding and trading Adani stock: Rajan New Delhi: …

- Khadi India announces khadi inspired showcase at Lakme Fashion Weekby Subhankar MandalKhadi India announces khadi inspired showcase at Lakme Fashion Week X FDCI Mumbai: With an aim to bring the …

Khadi India announces khadi inspired showcase at Lakme Fashion Week Read More »

- Sale of gold jewellery and gold artefacts hallmarked without six-digit code to be banned from Apr 1by Shruti SharmaSale of gold jewellery and gold artefacts hallmarked without six-digit code to be banned from Apr 1 New Delhi: …

- Swiggy, Zomato flag ‘misinterpretation’ of bike-taxi ban order by Delhi RTOby Shruti SharmaSwiggy, Zomato flag ‘misinterpretation’ of bike-taxi ban order by Delhi RTO New Delhi: Food delivery apps Swiggy and Zomato …

Swiggy, Zomato flag ‘misinterpretation’ of bike-taxi ban order by Delhi RTO Read More »

- Gold falls Rs 110; silver declines Rs 550by Subhankar MandalGold falls Rs 110; silver declines Rs 550 New Delhi : Gold price fell by Rs 110 to Rs …

- Govt. fixes retail price of 74 drug formulations treating diabetes and high blood pressureby Shruti SharmaPPA fixes retail price of 74 drug formulations New Delhi : Drug price regulator National Pharmaceutical Pricing Authority on Monday …

- Tips to Choose Perfect Western Business Attireby Zeeshan SidhuHow to Choose the Perfect Western Business Attire for Your Next Meeting? Have you had enough of wearing the same …

- PM Modi to release 13th instalment of Rs 16,800cr under PM-KISAN on Mondayby Subhankar MandalPM Modi to release 13th instalment of Rs 16,800cr under PM-KISAN on Monday New Delhi : Prime Minister Narendra …

PM Modi to release 13th instalment of Rs 16,800cr under PM-KISAN on Monday Read More »

- India needs a culture of honesty and no favouritism: Narayana Murthyby Aryan DasIndia needs a culture of honesty and no favouritism: Narayana Murthy Pune; India needs a culture of honesty, no …

India needs a culture of honesty and no favouritism: Narayana Murthy Read More »

- UP Finance Minister tables Budget FY24 in state Assemblyby Subhankar MandalUP Finance Minister tables Budget FY24 in state Assembly Lucknow : Uttar Pradesh Finance Minister Suresh Kumar Khanna on Wednesday …

UP Finance Minister tables Budget FY24 in state Assembly Read More »

- RBI cancels licence of MP-based Garha Co-operative Bankby Shruti SharmaRBI cancels licence of MP-based Garha Co-operative Bank Mumbai: The Reserve Bank of India (RBI) on Monday cancelled licence of …

RBI cancels licence of MP-based Garha Co-operative Bank Read More »

- Susan Wojcicki stepping down as CEO of YouTube, to be replaced by Indian-American Neal Mohanby Shruti SharmaSusan Wojcicki stepping down as CEO of YouTube, to be replaced by Indian-American Neal Mohan Washington : YouTube CEO …

- Air India places orders for 470 planes with Airbus, Boeing; deals estimated to be worth USD 80 bnby Shruti SharmaAir India places orders for 470 planes with Airbus, Boeing; deals estimated to be worth USD 80 bn New …

- India a seed market; to continue to invest for future growth: Mars Wrigleyby Aryan DasIndia a seed market; to continue to invest for future growth: Mars Wrigley New Delhi: India is a “seed …

India a seed market; to continue to invest for future growth: Mars Wrigley Read More »

- India topples France as UK’s largest Scotch whisky marketby Shruti SharmaIndia topples France as UK’s largest Scotch whisky market London: India has overtaken France to become the UK’s largest …

India topples France as UK’s largest Scotch whisky market Read More »

- What is Norstrat – Its Purpose, Services and Benefitsby Zeeshan SidhuHave you heard about a latest social media platform that is already setting bars high and making new waves, named …

What is Norstrat – Its Purpose, Services and Benefits Read More »

- Exclusive: Do you Know Bill Gates’ new girlfriend Paula Hurd? Read this…by Shruti SharmaWho is Bill Gates’ new girlfriend Paula Hurd? Know all about her Paula Hurd and Bill Gates have been …

Exclusive: Do you Know Bill Gates’ new girlfriend Paula Hurd? Read this… Read More »

- LIC chairman says, will meet Adani Group top management soonby Shruti SharmaLIC chairman says, will meet Adani Group top management soon Mumbai: The LIC management will soon meet the top …

LIC chairman says, will meet Adani Group top management soon Read More »

- E-Rupee to be piloted by 5 more banks in 9 more cities soonby Bhawna BhartiE-Rupee to be piloted by 5 more banks in 9 more cities soon Mumbai: Five more banks will join …

E-Rupee to be piloted by 5 more banks in 9 more cities soon Read More »

- Travellers from G20 nations can use UPI for payments in India: RBIby Shruti SharmaTravellers from G20 nations can use UPI for payments in India: RBI Mumbai : The Reserve Bank on Wednesday …

Travellers from G20 nations can use UPI for payments in India: RBI Read More »

- India biggest exporter of vaccines, mobile phones: Union Ministerby Aryan DasIndia biggest exporter of vaccines, mobile phones: Union Minister Thakur Jammu : India is now the hub of the …

India biggest exporter of vaccines, mobile phones: Union Minister Read More »

- No tax on income up to Rs 7 lakh, standard deduction allowed under new tax regimeby Subhankar MandalNo tax on income up to Rs 7 lakh, standard deduction allowed under new tax regime New Delhi: Finance …

No tax on income up to Rs 7 lakh, standard deduction allowed under new tax regime Read More »

- India 2024: Expecting slowdown in Indian economy from 6.8% in 2022 to 6.1% in 2023, before picking up to 6.8% in 2024 says IMFby Aryan DasExpecting slowdown in Indian economy from 6.8% in 2022 to 6.1% in 2023, before picking up to 6.8% in 2024 …

- Adani issues 413-page response, calls Hindenburg allegations attack on Indiaby Shruti SharmaAdani issues 413-page response, calls Hindenburg allegations attack on India New Delhi : Richest Indian Gautam Adani’s group on …

Adani issues 413-page response, calls Hindenburg allegations attack on India Read More »

- Adani Group stocks continue to fall; Adani Total Gas, Adani Transmission, Adani Green tank 20 pcby Bhawna BhartiAdani Group stocks continue to fall; Adani Total Gas, Adani Transmission, Adani Green tank 20 pc New Delhi : …

- India Stack Developer Conference : Govt expects 5-7 countries to sign up for adopting India tech stack by Marchby Shruti SharmaGovt expects 5-7 countries to sign up for adopting India tech stack by March New Delhi – The government …

- North East Economy: PM prioritizing energy sector in NE, claims Ministerby Shruti SharmaPM prioritizing energy sector in NE: Puri Guwahati : Prime Minister Narendra Modi has always prioritised the energy sector of …

North East Economy: PM prioritizing energy sector in NE, claims Minister Read More »

- India’s Economy: Debt per Indian increased by 2.53 times in 9 years of Modi govt, claims Congby Shruti SharmaDebt per Indian increased by 2.53 times in 9 years of Modi govt: Cong New Delhi: The Congress alleged on …

- Gujarat : India’s G20 presidency, B20 meet in Gujarat to deliberate on climate change and innovationby Correspondent / AgencyIndia’s G20 presidency: B20 meet in Gujarat to deliberate on climate change, innovation Ahmedabad : The Business 20 (B20) inception …

- Pakistan Economy: Foreign shipping lines may stop services for cash-strapped Pakistanby Shruti SharmaForeign shipping lines may stop services for cash-strapped Pakistan: Report Islamabad : Shipping agents have warned the cash-strapped Pakistan …

Pakistan Economy: Foreign shipping lines may stop services for cash-strapped Pakistan Read More »

- A sigh of relief for yellow metal loversby Aryan DasGold falls Rs 52; silver tumbles Rs 850 New Delhi, Here is a good news for all who had …

- Recession Alert : 73 pc CEOs globally expect eco growth to decline, claims PwC surveyby Correspondent / Agency73 pc CEOs globally expect eco growth to decline; most pessimistic outlook in over a decade: PwC survey Davos: …

Recession Alert : 73 pc CEOs globally expect eco growth to decline, claims PwC survey Read More »

- Why Indian CEOS are so successful globally? Read the remarkable points insideby Correspondent / AgencyIndian CEOs top global average on plans to cut operating costs Davos: Amid rising geopolitical risks, a vast majority …

Why Indian CEOS are so successful globally? Read the remarkable points inside Read More »

- PM Modi-Putin Relations: India’s Russian oil imports top 1 mn barrels a day in Decby Correspondent / AgencyIndia’s Russian oil imports top 1 mn barrels a day in Dec New Delhi: India’s import of crude oil from …

PM Modi-Putin Relations: India’s Russian oil imports top 1 mn barrels a day in Dec Read More »

- Over 18,500 toys seized from Hamleys, Archies and other retail stores for lack of BIS quality markby Correspondent / AgencyOver 18,500 toys seized from Hamleys, Archies and other retail stores for lack of BIS quality mark New Delhi: …

- Auto Expo 2023: Suzuki Motor unveils concept electric SUV, Others also in Raceby Correspondent / AgencyAuto Expo 2023 opens; Suzuki Motor unveils concept electric SUV Greater Noida: India’s flagship motor show Auto Expo 2023 kicked …

Auto Expo 2023: Suzuki Motor unveils concept electric SUV, Others also in Race Read More »

- Bank Fraud Case: Kochhars’ arrest in loan case not as per provisions of law, rules HC; grants bailby Correspondent / AgencyKochhars’ arrest in loan case not as per provisions of law, rules HC; grants them interim bail Mumbai : …

- Reliance Jio rolls out 5G internet services in Jaipur, Jodhpur, Udaipurby Correspondent / AgencyReliance Jio rolls out 5G internet services in Jaipur, Jodhpur, Udaipur Jaipur: Private telecom company Reliance Jio launched 5G …

Reliance Jio rolls out 5G internet services in Jaipur, Jodhpur, Udaipur Read More »

- New Reforms: No need to visit bank to update KYC, Know moreby Correspondent / AgencyNew Delhi: Bank account holders are no longer required to visit their bank branches to update ‘know your customer’ …

New Reforms: No need to visit bank to update KYC, Know more Read More »

- India’s GDP nearing to $20 trillion, per capita income at $10k by 2047: Govt.by Correspondent / AgencyHyderabad: India’s GDP will be close to USD 20 trillion by 2047 and per capita income may reach USD …

India’s GDP nearing to $20 trillion, per capita income at $10k by 2047: Govt. Read More »

- Zomato Co-founder, CTO Gunjan Patidar resignsby Correspondent / AgencyNew Delhi: Online food delivery platform Zomato Ltd said its Co-founder and Chief Technology Officer Gunjan Patidar resigned from …

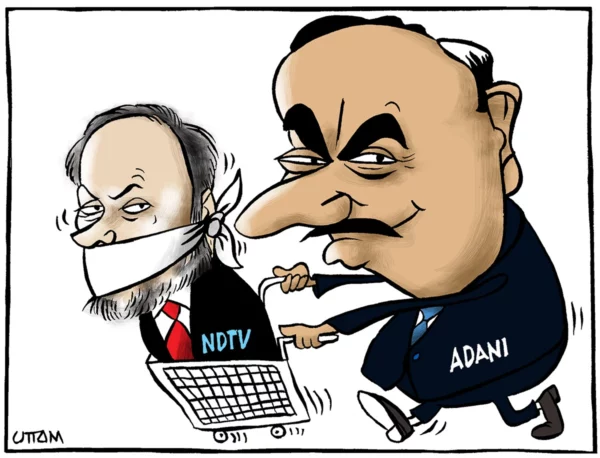

- Adani takes control of NDTV, Prannoy & Radhika Roy resignby Correspondent / Agency`New Delhi: Adani group on Friday gained full control of news broadcaster NDTV after it acquired most of the stake …

Adani takes control of NDTV, Prannoy & Radhika Roy resign Read More »

- Get Ahead Of Your Competition With Leads Finderby kshvid-adminAre you looking for an edge in your business? Trying to get ahead of the competition and make sure your …

- Background of Chanda Kochhar: The banking sector titan who fell offby Subhro MajumderNew Delhi: Chanda Kochhar, who was jailed for a cash-for-loan fraud on Friday, was once a powerful banker and critical …

Background of Chanda Kochhar: The banking sector titan who fell off Read More »

- NDTV co-founders and shareholders to sell most of their stake in broadcaster to Adani Groupby Subhro MajumderNew Delhi: NDTV founders Prannoy Roy and also his spouse Radhika Roy on Friday said they will market 27.26 percent …

- Deadline for 30 per cent cap on UPI transactions by third-party payments firms extended, declares NPCIby Subhro MajumderNew Delhi [India]: The timelines for conformity of existing 3rd party Application Providers who are exceeding the suggested volume cap, …

- Do You Know the Fate of Crypto in India? Read thisby Correspondent / AgencyBy Mahiya Fayaz Sheikh Bangalore: For as long as we can remember, investments have always been restricted to assets such …

Do You Know the Fate of Crypto in India? Read this Read More »

- End-to-end encryption being tested for group chats on Google Messages applicationby Subhro MajumderWashington [United States]: Search giant Google recently revealed that it was carrying out a variety of tests for end-to-end encryption …

End-to-end encryption being tested for group chats on Google Messages application Read More »

- Tata Group Announcement : Merger of Air India and Vistara by March 2024by Correspondent / AgencyMumbai (Maharashtra) : The Tata Group on Tuesday announced the merger of its 2 airlines Vistara as well as Air …

Tata Group Announcement : Merger of Air India and Vistara by March 2024 Read More »

- Employees resign from Twitter in masses after Elon Musk’s ‘extremely hardcore’ ultimatumby Subhro MajumderWashington [US]: Twitter employees are exiting the company in numbers after they apparently obtained a final word from Elon Musk to …

Employees resign from Twitter in masses after Elon Musk’s ‘extremely hardcore’ ultimatum Read More »

- Facebook parent company Meta to cut expenses by slashing 11,000 jobsby Subhro MajumderWashington [United States]: Facebook parent Meta revealed on Wednesday to slash around 11,000 jobs as a part of mass discharges to …

Facebook parent company Meta to cut expenses by slashing 11,000 jobs Read More »

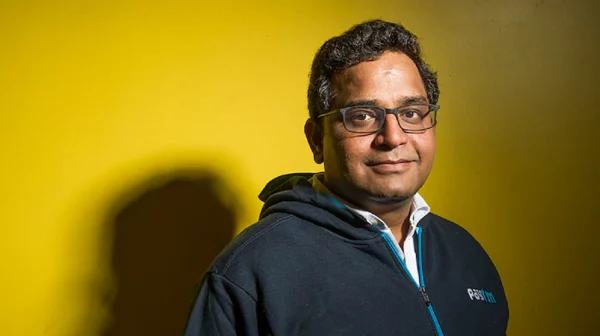

- Paytm Quarter 2 revenue rises 76 per cent to Rs 1,914 croreby Subhro MajumderNew Delhi [India]: India’s leading electronic payments and financial solutions business Paytm on Monday posted a 76 percent year-on-year growth …

Paytm Quarter 2 revenue rises 76 per cent to Rs 1,914 crore Read More »

- Elon Musk threatens to name shame advertisers that are backing out from Twitterby Aryan DasWashington [United States]: Tesla chief executive officer Elon Musk endangered to name-shame the advertisers that are backing out from Twitter …

Elon Musk threatens to name shame advertisers that are backing out from Twitter Read More »

- “You get what you spend for:” Elon Musk on ‘blue tick’ criticismby Bhawna BhartiWashington [US]- After facing criticism for his strategy to charge Twitter users USD 8 a month to obtain or keep …

“You get what you spend for:” Elon Musk on ‘blue tick’ criticism Read More »

- Air India plans to acquire AirAsia India, Big Move by Tata Groupby Aryan DasNew Delhi [India]- Air India on Wednesday revealed that it signed contracts to complete the purchase of 100 per cent …

Air India plans to acquire AirAsia India, Big Move by Tata Group Read More »

- musk claims Twitter will bill USD 8 a month for ‘blue tick’by Aryan DasWashington [US]: Tesla Chief Executive Officer Elon Musk on Tuesday announced a brand-new variation of “Twitter Blue” where he intended …

musk claims Twitter will bill USD 8 a month for ‘blue tick’ Read More »

- Tesla (The Electric Car Company)by Imran BangashTesla, Inc. is a manufacturing company in America that makes clean energy and electric vehicles. Tesla Company originally found in …

- Elon Musk talks about return of Donald Trump on Twitterby Subhro MajumderWashington [United States]: Tesla Chief Executive Officer Elon Musk, who recently acquired Twitter, on Monday took to the micro-blogging website …

Elon Musk talks about return of Donald Trump on Twitter Read More »

- Why Do You Need A Business Plan To Be A Successful Entrepreneurby Imran Bangash“An entrepreneur tends to bite off a little more than he can chew hoping he’ll quickly learn how to chew …

Why Do You Need A Business Plan To Be A Successful Entrepreneur Read More »

- ”Bird is freed” tweets Elon Musk, will turn around ‘life bans’by Aryan DasWashington [United States] : After completing his USD 44 billion acquisition of Twitter Inc, Elon Musk has said that he …

”Bird is freed” tweets Elon Musk, will turn around ‘life bans’ Read More »

- The Endpoint Security Discipline on Cloud Computing Architectureby Imran BangashEndpoint Security: Background and Overview Host devices are always the best choice and target audience for public network hackers, especially …

The Endpoint Security Discipline on Cloud Computing Architecture Read More »

- Cory Nieves: A young CEO who will leave you shocked !!by Subhro MajumderBy Kshvid News Desk Nobody knows this better than young entrepreneurs, that age is not a reliable success indicator. …

Cory Nieves: A young CEO who will leave you shocked !! Read More »

- Reliance Jio comes to be largest wireline player with 7.3 million customers, points out TRAI databy Subhro MajumderNew Delhi [India]: Reliance Jio has actually come to be the largest wireline player with 7.3 million subscribers going beyond …

- How to Become a Successful Entrepreneur?by Imran BangashA successful entrepreneur has a strong opinion about their perspectives and determination for success. While you start up your business, …

- Nokia gets deal, to provide 5G equipment to Reliance Jioby Subhro MajumderNew Delhi [India]: Nokia on Monday stated it has been selected as a major supplier by Reliance Jio to provide …

Nokia gets deal, to provide 5G equipment to Reliance Jio Read More »

- Teenagers Caroline and Isabel Bercaw have demonstrated great talent and creativity!!by Subhro MajumderEntrepreneurs are those individuals who have left their comfort zone and joined the ranks of success. Success takes time, but …

Teenagers Caroline and Isabel Bercaw have demonstrated great talent and creativity!! Read More »

- Twitter-Musk trial: Judge grants request to halt trial until October 28by Subhro MajumderWashington [United States]: The Twitter-Musk trial is now on time out. Yes, you read it right. A Delaware court has actually …

Twitter-Musk trial: Judge grants request to halt trial until October 28 Read More »

- Government, Life Insurance Corporation to divest 60.72 per cent stake in IDBI Bankby Subhro MajumderNew Delhi [India]: The Federal government of India and Life Insurance Corporation of India (LIC) will certainly together unload 60.72 per …

Government, Life Insurance Corporation to divest 60.72 per cent stake in IDBI Bank Read More »

- Akash Ambani only Indian to be featured in Time magazine’s 100 emerging leaders’ listby Subhro MajumderNew Delhi [India]: Akash Ambani, the eldest of two sons of Reliance Industries chairman Mukesh Ambani has found his name …

Akash Ambani only Indian to be featured in Time magazine’s 100 emerging leaders’ list Read More »

- ED not investigating anything new, searches linked to ongoing probe, clarifies Paytmby Subhro MajumderNew Delhi [India]: The Enforcement Directorate (ED) is not exploring anything new and the investigation authorities have actually sought additional …

ED not investigating anything new, searches linked to ongoing probe, clarifies Paytm Read More »

- Get to know Indian-origin Laxman Narasimhan, the new CEO of Starbucksby Subhro MajumderBy Kshvid News Desk Starbucks Corporation, headquartered in Seattle, Washington, is the world’s biggest coffee shop business. The company is …

Get to know Indian-origin Laxman Narasimhan, the new CEO of Starbucks Read More »

- Government carries out e-auction of eight coal mines across five statesby Subhro MajumderNew Delhi [India]: The Ministry of Coal on Tuesday carried out e-auction of eight mines spread out in 5 states …

Government carries out e-auction of eight coal mines across five states Read More »

- QUEO- Bathroom Brand Launches A New Collection Of Luxury Faucets & Sanitarywareby Apoorva SinghNew Delhi [India]: QUEO, the main luxury bathroom brand from the house of Hindware Limited nowadays launched a new collection …

QUEO- Bathroom Brand Launches A New Collection Of Luxury Faucets & Sanitaryware Read More »

- Government tightens noose around Chinese shell companiesby Aryan DasNew Delhi [India]- The Ministry of Corporate Matters (MCA) on Thursday initiated a suppression on Indian entities that were supplying …

Government tightens noose around Chinese shell companies Read More »

- Tata Sons ex-chairman Cyrus Mistry dies in road crash, PM Modi and Others express Griefby Aryan DasMumbai (Maharashtra) [India]: Former Tata Sons chairman Cyrus Mistry was killed in a road crash near Mumbai on Sunday. According …

Tata Sons ex-chairman Cyrus Mistry dies in road crash, PM Modi and Others express Grief Read More »

- India will become Second Largest Economy by 2047: Govt.by Bhawna BhartiNew Delhi [India]: Within a couple of years from currently India will certainly be amongst the leading four economies globally …

India will become Second Largest Economy by 2047: Govt. Read More »

- Saif Ali Khan’s House of Pataudi Unveils Its First Store In Bengaluru’s Phoenix Market Cityby Apoorva SinghBengaluru (Karnataka) [India]: Saif Ali Khan’s House of Pataudi (HoP), one of the most loved ethnic and occasion wear brands …

- Tesla CEO Elon Musk sends second termination letter to Twitter as legal battle ragesby Subhro MajumderWashington [United States]: Tesla CEO Elon Musk on Monday sent out a second bargain termination letter to Twitter by “leveraging” …

Tesla CEO Elon Musk sends second termination letter to Twitter as legal battle rages Read More »

- Gautam Adani is now world’s third Richest person, overtakes Louis Vuitton chiefby Aryan DasNew Delhi [India]: Service empire Adani Group’s chairman Gautam Adani is now the world’s third-richest individual after surpassing France’s Bernard …

Gautam Adani is now world’s third Richest person, overtakes Louis Vuitton chief Read More »

- Mukesh Ambani introduces daughter Isha Ambani as Reliance’s next retail business leaderby Subhro MajumderMumbai (Maharashtra) [India], August 29 (ANI): Mukesh Ambani, while addressing the online Annual General Meeting (AGM) of Reliance Industries on …

Mukesh Ambani introduces daughter Isha Ambani as Reliance’s next retail business leader Read More »

- Planning to allow small investors to invest in road projects, says Nitin Gadkariby Subhro MajumderNew Delhi [India]: Union Road Transport and Highway Minister Nitin Gadkari said the government is formulating a new model through …

Planning to allow small investors to invest in road projects, says Nitin Gadkari Read More »

- Vijay Shekhar Sharma reappointed as Paytm CEO, 99.67 pc shareholders vote for himby Subhro MajumderNew Delhi [India]: Vijay Shekhar Sharma has been reappointed as Paytm Managing Director and Chief Executive Officer as 99.67 per …

Vijay Shekhar Sharma reappointed as Paytm CEO, 99.67 pc shareholders vote for him Read More »

- Bajaj Hindusthan Sugar to face insolvency proceedings from SBIby Subhro MajumderMumbai (Maharashtra) [India]: The country’s largest lender State Bank of India has initiated insolvency proceedings against Bajaj Hindusthan Sugar Limited, …

Bajaj Hindusthan Sugar to face insolvency proceedings from SBI Read More »

- Odisha government accepts Adani Group’s proposition to invest Rs 57,575 cr for two projectsby Subhro MajumderNew Delhi [India]: Adani Group will invest Rs 57,575 crore in 2 projects in Odisha. A Chief Minister Naveen Patnaik-headed …

- Tata Motors’ subsidiary acquires Ford’s plant in Gujarat in whopping Rs 726 crore dealby Subhro MajumderNew Delhi [India]: Tata Motors’ electric vehicle arm Tata Passenger Electric Mobility has acquired a Ford India factory located at …

Tata Motors’ subsidiary acquires Ford’s plant in Gujarat in whopping Rs 726 crore deal Read More »

- LG unveils its Ultra Android Tab with Snapdragon 680by Subhro MajumderWashington [US]: South Korean multinational conglomerate LG might be out of the smartphone business but it just released a new …

LG unveils its Ultra Android Tab with Snapdragon 680 Read More »

- ED raids director of crypto company WazirX, freezes Rs 64.67 croreby Bhawna BhartiMumbai (Maharashtra) [India]: The Directorate of Enforcement (ED) stated on Friday it had carried out searches on the premises of …

ED raids director of crypto company WazirX, freezes Rs 64.67 crore Read More »

- No GST on ‘Sarais’ operated by Charitable trusts: Govt.by Poornima DasNew Delhi [India]: The central government has cleared the air regarding doubts about goods and services tax (GST) on Sarais …

No GST on ‘Sarais’ operated by Charitable trusts: Govt. Read More »

- OnePlus teases OxygenOS 13 based Android 13 with new water-inspired designby Subhro MajumderShenzhen [China]: OnePlus unveiled the OnePlus 10T and OxygenOS 13 at the same time (hands-on). According to GSM Arena, OxygenOS …

OnePlus teases OxygenOS 13 based Android 13 with new water-inspired design Read More »

- Samsung to produce better panels for iPhone 14 Pro duo modelsby Subhro MajumderSeol [South Korea]: Samsung’s LTPS backplanes and the M11 material collection will be utilized in the vanilla iPhone 14 (6.1″) …

Samsung to produce better panels for iPhone 14 Pro duo models Read More »

- Piracy: An ever-growing Concern for the Film Industry amid Tech Advancementby Subhro MajumderBy Subhro Majumder The practice of piracy of movies is expanding and affecting the global movie industry more with each …

Piracy: An ever-growing Concern for the Film Industry amid Tech Advancement Read More »

- US invites South Korea to Join semiconductor club Chip 4, China worrisomeby Poornima DasWashington [United States]: After the United States welcomed South Korea to join its semiconductor partnership “Chip 4” to build a …

US invites South Korea to Join semiconductor club Chip 4, China worrisome Read More »

- Fed Strikes United States Inflation With One More 75 Basis Rate Hikeby Poornima DasWashington: The US Federal Book on Wednesday again elevated the benchmark rate of interest by three-quarters of a portion factor …

Fed Strikes United States Inflation With One More 75 Basis Rate Hike Read More »

- Russia-Ukraine war, rising petrol price push rupee fall: Govtby Aryan DasNew Delhi [India]- The recurring Russia-Ukraine conflict, soaring petroleum costs, and tightening of worldwide economic conditions are significant factors for …

Russia-Ukraine war, rising petrol price push rupee fall: Govt Read More »

- Pakistani rupee plunges down to PKR 231 against Dollar!by Correspondent / AgencyIslamabad [Pakistan]- Pakistan rupee dropped at a record low versus the United States buck on Tuesday as it went down …

Pakistani rupee plunges down to PKR 231 against Dollar! Read More »

- Trade body contacts States, seeks GST withdrawal on unbranded packed foodsby Correspondent / AgencyNew Delhi [India]: Trade body Confederation of All India Traders (CAIT) has created a letter to the Principal Ministers as …

Trade body contacts States, seeks GST withdrawal on unbranded packed foods Read More »